School board approves max levy, fields questions

News | Published on December 23, 2021 at 11:31am EST | Author: Chad Koenen

0Tax levy up almost 51 percent

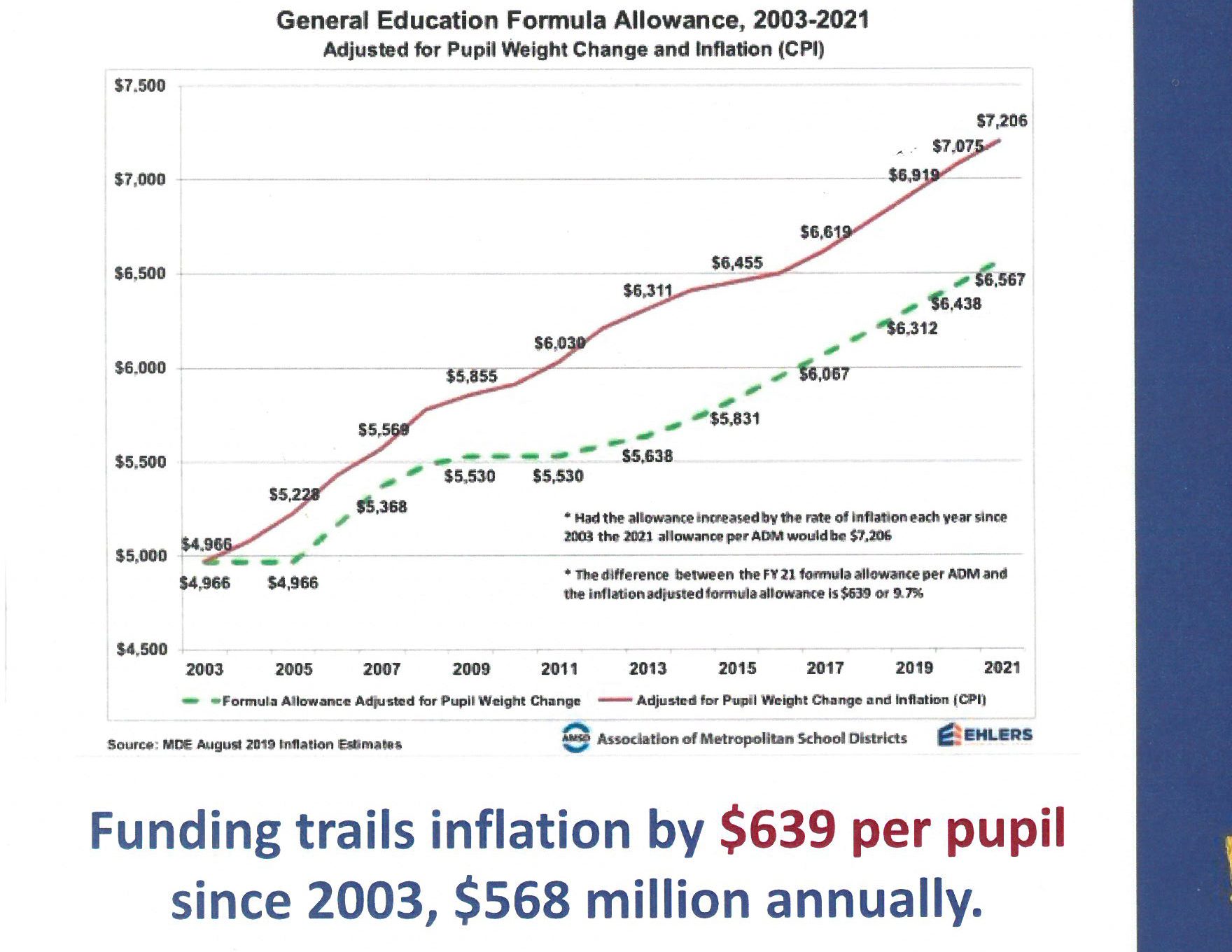

The graph provided to the school board during the truth and taxation meeting showed how funding per student has not kept up with the cost of inflation.

By Barbie Porter

Editor

The Frazee-Vergas School Board fielded questions from residents about an increase in school taxes during its monthly board meeting on Monday, Dec. 13.

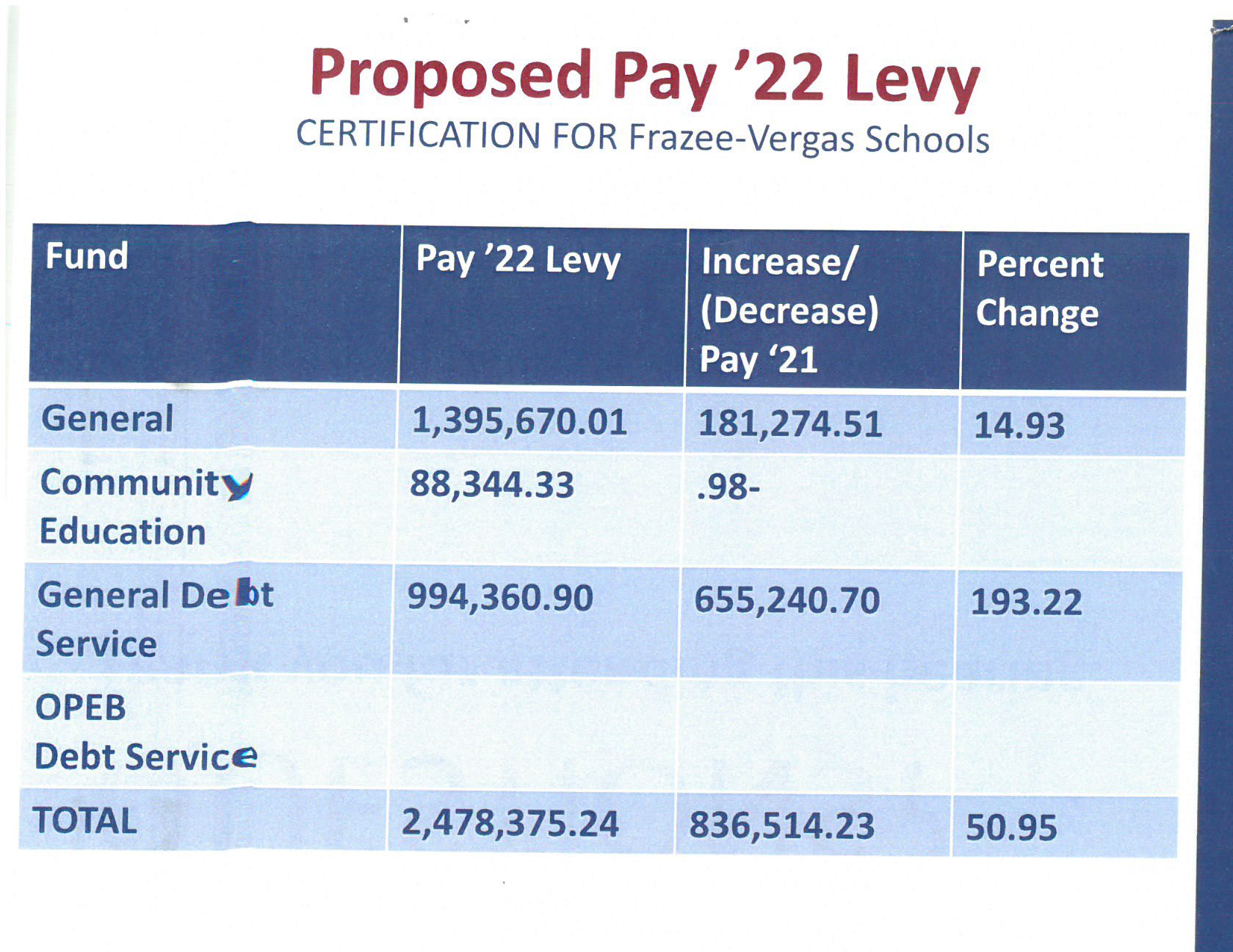

The school board approved the full levy amount that it recommended in September. The total tax levy increased for 2022 by almost 51 percent. The increase will bring in a projected additional $836,514 to the district for a total of $2.45 million.

A school district resident inquired as to who approved that increase and the projects associated with the increase.

The resident was informed the projects include new parking lots, heating and ventilation and fire safety systems in the high school as well as a new track and field complex. It was also noted the board unanimously approved the projects.

The woman recalled a few years ago the district asked voters to approve a building bond for some of those projects and it failed. She asked how the school board was able to move forward without voter approval.

It was explained the projects were funded through non-voter approved bonds, due to student safety concerns.

School board member Thaddeus Helmers explained the parking lot across from the high school is divided by State Highway 87 and the parking lot at the elementary is not sufficient to accommodate bus traffic, resulting in students and parents darting between parked busses into street traffic.

He added the ventilation systems at the high school makes learning difficult when room temperatures might be too cold or too hot. Also, a new fire suppression system in parts of the high school needed to be installed.

The district has patched the track surface for several years, but the surface has cracked to the point that it is a hazard.

The graph provided to the school board during the truth and taxation meeting showed the breakdown of the 2022 levy funds.

School board member Tammie Nunn explained, when on project is taken on a snowball effect takes place, as the district is then required to address other deficiencies. Those included making the bleachers ADA compliant, as well as the public bathrooms and concession stand facility.

The resident asked why the school board didn’t go with the non-voter approved bonds to pay for the projects to begin with and skip the voter-approved referendum?

It should be noted the referendum the individual referred to had multiple questions, one of which passed. The one the voters approved was in regards to updating an older section a the elementary school by replacing windows and fake walls, as well as the heating and ventilation system.

Helmers explained the other referendum questions that failed included more projects than what is allowed now through bonding to address student safety concerns. Some additional items on the referendum included a new commons area, theatre and band room.

The board was asked if there was a limit the district could spend.

Superintendant Terry Karger said there is not a limit to the amount that can be spent for student safety, but there are limitations as to what can be done in the name of student safety.

The discussion came with the required Truth and Taxation meeting the board hosted. The board was provided a presentation that explained how property taxes are determined through market value given to properties by the county assessor and other formulas.

Karger noted since 2003 the general education formula allowance has seen funding trailing inflation by $639 per pupil. The graph provided showed in 2003 the per pupil funding was bout $5,000. In 2021 the funding was about $6,500, whereas the inflation rate was about $7,200.

The board also reviewed the projected 2021-2022 budget which started June 30 2021 and concludes at the end of June in 2022.

Total funds projected to start the year were about $3.37 million. The district expects revenues of $11.89 million and expenditures of $13.24 million to end the year with projected total funds of $2.03 million.

The presentation noted of the total revenues, $1.64 million were brought to the district through property taxes. The percentage levied to total budget were reported to be $13.8 percent.