School board adopts 6.1 percent levy increase

News | Published on December 16, 2025 at 3:14pm EST | Author: frazeevergas

0By Robert Williams

Editor

The Frazee-Vergas School District announced a 6.10 percent levy increase during a Truth in Taxation meeting on Monday, Dec. 8, prior to the monthly school board meeting.

The proposed payable 2026 levy is $2,846,008. The levy was approved by the school board later in the meeting.

That includes a general fund balance of $1,563,004.17, down 1.34 percent; a community education balance of $95,089.94, up 11.56 percent and a general debt service balance of $1,187,913.89, up 17.28 percent.

The district tax levy is set by the state’s general education formula allowance from the legislature and voter-approved building bonds and operating referendums.

The district does not have an operating referendum in place. Some districts use these to close the gap between funding and inflation.

“Our stance has been let’s make do with what we have,” said Superintendent Terry Karger. “We have had our voters vote on some, very little, with levies going on so we are pretty light in that area.”

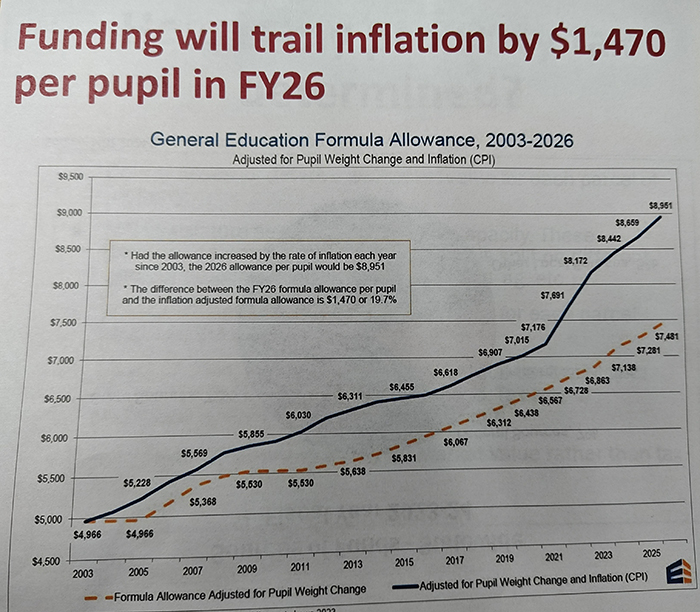

The state’s general education formula did increase by 2.74 percent, which was helpful, but the funding will trail inflation by $1,470 per pupil in fiscal year 2026.

“It would be nice to see inflation and the formula close the gap,” said Karger.

The district’s total revenue is $15,036,881 and the district receives $2,682,348 from property taxes, which equates to 17 percent. Significant changes in the budget from 2025 came from limiting long term facility maintenance (LTFM) expenses and the current proposed budget did not have any negotiation increases. There will be negotiations in the spring.

This past summer, the board approved a 10-year facility maintenance plan, with roof repairs being the major hurdle tackled.

The Ag2School Ag and Rural Land Credit, created in 2017, is now at its maximum of 70 percent. That revenue comes from state income, sales and other tax revenue.

“It is a nice opportunity for land owners and timber owners to not have to pay as much as they did years ago,” said Karger. “It’s at its max and we foresee it staying there. It’s a nice reward for our farmers and timber owners.”

Audit of 2025 approved

The 2025 district audit report, presented by Brian Opsahl, CPA, from Brady Martz & Associates, was presented and approved by the school board.

The district’s combined net position was $7,383,079 on June 30, 2025, a decrease of 8.9 percent from the previous year.

“This is on a full accrual level, basically giving you credit for what your assets are worth, like your buildings less depreciation and long-term debt,” Opsahl said.

Total general fund revenue in 2025 was 13,303,841, an increase of $541,882 or 4.2 percent from 2024’s 12,761,959.

Total general fund expenditures in 2025 were $13,956,217, an increase of 903,933 or 6.9 percent.

In a budgetary comparison for the general fund, revenues were $159,756 more than projected; expenditures were $154,289 under budget.

“Overall, you had anticipated being down $966,000, but we’re only down $652,000, so, a positive variance there of $314,000 from what you anticipated,” said Opsahl.